A group of experts in Tokyo suggested pouring radioactive water from Fukushima into the open sea. A marine biochemist explains the consequences of this absurd decision.

Indian coal giant Adani’s Carmichael project, worth 16.5 billion Australian dollars, in the Galilee basin in Queensland is projected to be the largest mine in Australia and one of the largest in the world. After an international campaign to block it, Gautam Adani, the Indian billionaire founder of the conglomerate of the same name, announced

Indian coal giant Adani’s Carmichael project, worth 16.5 billion Australian dollars, in the Galilee basin in Queensland is projected to be the largest mine in Australia and one of the largest in the world. After an international campaign to block it, Gautam Adani, the Indian billionaire founder of the conglomerate of the same name, announced the project’s final approval on the 6th of June describing it as “one of the largest single infrastructure and job-creating developments in Australia’s recent history”. But banks are refusing to invest in it due to the increasing risks related to coal and negative environmental output of the project, including threatening the Great Barrier Reef.

It is estimated that it will have a lifetime output of 2.3 billion tonnes of coal and contribute 2.97 billion Australian dollars to the Queensland economy each year for the next 60 years. It was reported that it will create 10,000 jobs – a claim later rejected by economist Jerome Fahrer who said that it will create only 1,500 jobs and that the company’s figures were “significantly exaggerated”.

Read more: Pacific island nations are planning to phase out fossil fuels

However, no bank has expressed interest in funding the project which involves a mine, a port and a 189 kilometre railway line in Queensland. Mr. Adani has admitted that the company is still facing problems finding financing. Some banks are worried about the reputational risks of being involved in a large coal project, and others about the risks of funding what could turn out to be a giant stranded asset – an asset that will suffer from unexpected devaluation.

Read more: AXA Investment Managers divests 165 million euros from coal

Deutsche Bank and HSBC have said they won’t fund Adani’s project following a successful lobbying campaign focused on the fact that coal from Carmichael would have to be shipped across the Great Barrier Reef, with the risk of causing damage to the world heritage site. National Australia Bank said in 2015 it would focus on funding renewable energy while Westpac has said it will only finance “existing coal producing basins”. Meanwhile, State Bank of India, the country’s largest government-owned bank, has also backed away according to people close to the project. One senior investment banker in Mumbai adds that many others will already be nearing their lending limits to the Adani Group.

Lenders are also worried about the economics of the project. Firstly, the price of coal from Newcastle Port in Australia remains less than half of what it was in 2010 – below what analysts say is needed for Carmichael to be profitable. Secondly, although Piyush Goyal, India’s Energy Minister, has offered reassurances that there will be a demand for coal from Carmichael due to its higher quality, there are concerns about where the coal will go, especially given that the Indian government is trying to end the country’s dependence on coal imports.

Read more: Energy in India. The time has come to alter the energy balance, but at what cost

Thirdly, bankers are concerned about the company’s ability to repay any loans given already high debt levels and a weak balance sheet. Net debt across Adani Group’s four listed companies amounted to around 15.5 billion dollars by the end of March 2016 according to S&P Global Market Intelligence — eight times their combined earnings before interest, tax, depreciation and amortisation.

Finally, with the prices of solar energy falling exponentially globally and especially in India, there are worries that even if the project is completed its backers could be left with an expensive stranded asset. The Energy and Resources Institute (TERI) in New Delhi has calculated that the price of solar power is dropping so quickly that there could be no need for coal power by 2050. The Carmichael coal mine is supposed to run until 2077.

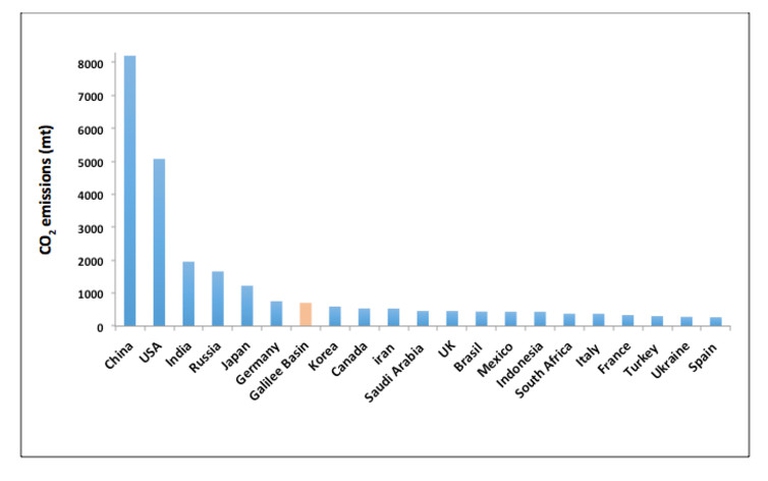

To meet the obligations of the Paris Agreement on climate change to limit global warming to well below 2 degrees Celsius, it is widely accepted that 90 per cent of Australia’s coal will need to stay in the ground. The proposed extraction of 2.3 billion tonnes of coal is a direct contradiction to such efforts. The 4.7 billion tonnes of greenhouse gas emissions associated with the mine will be equivalent to nine times Australia’s overall emissions in 2014.

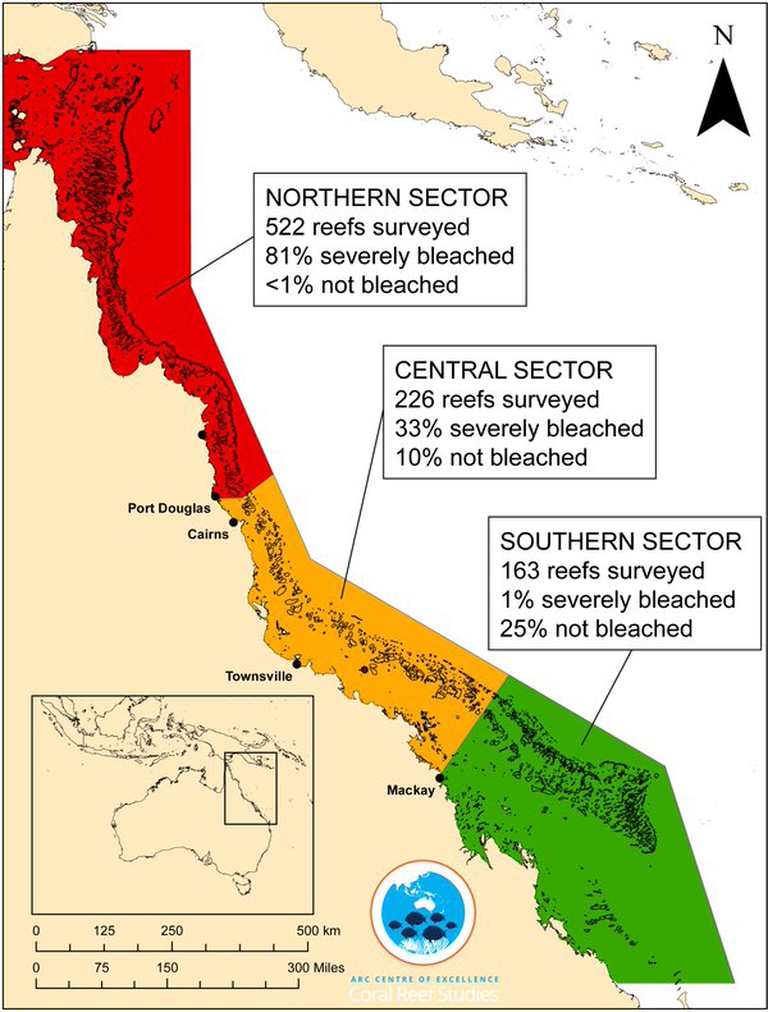

In addition, environmentalists argue the Great Barrier Reef is already at a catastrophic tipping point following back-to-back coral bleaching events. Although the original Adani plan involved dumping the dredge sediment at sea the current plan to dump such spoils on wetlands still won’t save the reef because the actual dredging process involves clearing the seabed. The current plan is still controversial also because the wetlands are an important habitat for at least 22 migratory shore birds listed under Australian environmental protection legislation.

Furthermore, Adani’s Carmichael mine will destroy some of the most important remaining habitat for the endangered black throated finch, which has already lost 80 per cent of its habitat. As a result, Adani has been required to create “offsets,” which are supposed to provide alternative habitats for the birds. However, the Australian Conservation Foundation (ACF) said it has serious concerns about the offset plan being put in place by Adani as according to experts it is completely inadequate and they’ve now asked Australia’s Minister for the Environment and Energy, Josh Frydenberg to revoke the approval of the mine and ask Adani to resubmit its plans for consideration.

Adani has been granted unlimited access to groundwater and the company merely needs to monitor and report the amount of water it extracts with a permit that runs until 2077 – without independent or government oversight. Consequently, Farmers for Climate Action, which brings together more than 2,000 farmers and agriculture leaders concerned about climate change, joined the Stop Adani alliance after a petition was filed calling on the Queensland premier, Annastacia Palaszczuk, to rescind her commitment to give Adani unlimited free access to groundwater used by the region’s farmers. The Carmichael mine in its current form would extract 12 billion litres of water each year in a region where communities and ecosystems are already highly reliant on groundwater due to variable surface water levels.

“For every tonne of sugar cane they (farmers) grow, they tell me they’re paying about 10 dollars for electricity and water allocation. That’s pushing a lot of growers back into a loss-making situation. That’s regardless of whether it rains or not, and when it rains — because you pay for the licence even if you don’t end up needing the water. At the same time, we’re saying to a major international company that it can have as much as it likes. Sounds like two sets of rules to me” (Robert Quirk, Australian farmer)

“I deal daily with the devastating impacts of coal while working with some of India’s poorest people. Adani tops the list of the worst companies I have come in contact with in my work. The damage that Adani has done to our people can’t be overstated: local fishing communities unable to access their fishing grounds; vast quantities of coal spilled into the oceans and not cleaned up for years, devastating local tourism, beaches and marine life. Adani’s mine must never be allowed to go ahead” (Indian environmental justice advocate Doctor Vaishali Patil)

Given the clear environmental and social impacts this mine will have not just for the region but for the whole planet, it is very hard to justify the value of the short-term profit (if any) coming out of this project. Global campaigns waged by environmental groups, religious leaders and farmers, as well as falling renewable prices have no doubt dealt a blow to the Australian coal mining industry. Investors and governments are being targeted for their continued support of this activity in the face of so many long-term challenges. For a company like Adani profiting on the back of the common people is a regular business model, however, the fact that the authorities are complicit in this is disheartening.

Siamo anche su WhatsApp. Segui il canale ufficiale LifeGate per restare aggiornata, aggiornato sulle ultime notizie e sulle nostre attività.

![]()

Quest'opera è distribuita con Licenza Creative Commons Attribuzione - Non commerciale - Non opere derivate 4.0 Internazionale.

A group of experts in Tokyo suggested pouring radioactive water from Fukushima into the open sea. A marine biochemist explains the consequences of this absurd decision.

The decline in grey and humpback whales in the Pacific and Atlantic Oceans has been traced to food shortages caused by rising ocean temperatures.

The United Nations has launched a major international alliance for ocean science, undertaking a mission close to all our hearts.

The cargo ship that ran aground off the coast of Mauritius on 25 July, causing incalculable damage, has split in two and its captain has been arrested.

The largest coral reef in the world is severely threatened by climate change, but researchers are developing strategies that could contribute to saving the Great Barrier Reef.

Seychelles have extended its marine protected area, which now covers over 400,000 square kilometres, an area larger than Germany.

Norwegian oil giant Equinor had pulled out of drilling for oil in the Great Australian Bight, one of the country’s most uncontaminated areas. A victory for activists and surfers who are now campaigning for the area to be protected forever.

30 per cent of the planet needs to be protected to stop precipitous species decline. The UN has set out its aims for the the COP15 on biodiversity scheduled for Kunming, China in October.

Ocean warming has risen to record highs over the last five years: just in 2019 the heat released into the world’s oceans was equivalent to that of 5-6 atomic bombs per second. The culprit, no doubt, is climate change.