At the dawn of a new era, women in Japan still face old challenges: they’re paid less than men and struggle to scale the professional ladder. How can the impasse be broken?

More and more wealthy families care about our Planet. Data emerged from the Investing for Global Impact prove this.

Do the world’s wealthy families only aim to get richer? It might be true in some cases but luckily awareness levels have changed over the years. And millionaires are increasingly trying to use their money to change the world for the better. The Investing for Global Impact report proves this.

Investing for Global Impact 2017 is a report by the Financial Times written in collaboration with GIST (Global Impact Solutions Today) and supported by the UK’s Barclays bank. The fourth edition of the report was presented in March in Paris, France. The study is one of a kind as it assesses two macro areas: impact investing, i.e. investments that generate financial return alongside a positive, measurable impact on people and the Planet; and philanthropy, i.e. charitable activities that – contrary to investments – are non-refundable.

The research also stands out for the choice of interviewees. While similar studies usually involve banks, pension funds or insurance companies, Investing for Global Impact focuses on those who manage wealthy families’ assets: foundations and family offices. Foundations are widespread globally but family offices are established mainly in the United States. They’re service companies that manage the assets of one or more wealthy families (in this case they’re called multi-family offices or multi-client family offices). On the one hand they provide advice in the financial, fiscal and philanthropic fields, while on the other hand they manage investments and accounting. They can be independent companies or owned by big banks.

A total of 246 respondents from 45 countries were included in the survey, 35 per cent more than in the previous edition. For the first time researchers took a number of family offices and foundations that aren’t currently involved in impact investing and philanthropy into consideration, in order to comprehend their choices and assess future developments.

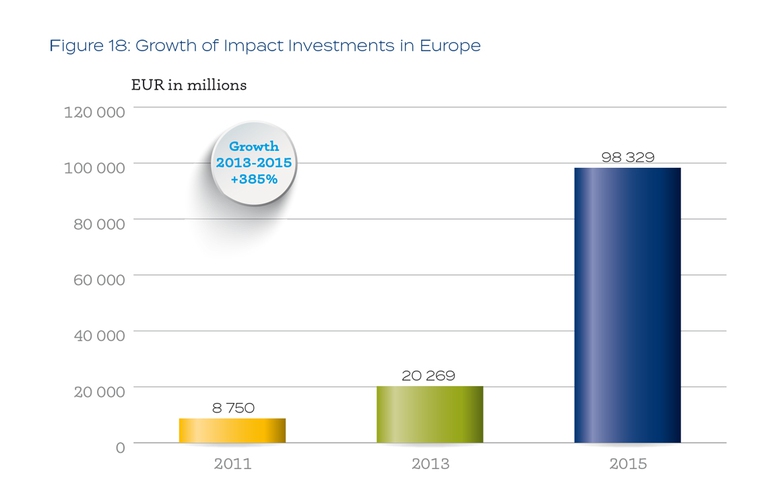

Some hopeful signs emerge from the Investing for Global Impact report. The investment decisions of wealthy families appear to be more frequently influenced by non-financial factors such as CSR (Corporate Social Responsibility) and ESG (Environmental, Social and Governance criteria). Generally, impact investing is thought to be a more efficient choice compared to philanthropy. Also, it is no longer an exception but an integral part of wealthy families’ investment portfolios just like any other financial instrument. This isn’t an obvious fact as impact investing is the latest “arrival” in the large family of sustainable investments. And in some ways, it is the most advanced and innovative strategy.

For many years the greatest obstacle to sustainable investments has been the fear of sacrificing returns. But this belief has been proven wrong by facts. This year 90 per cent of family offices and foundations achieved positive financial returns as a result of impact investing, in line with market rates. Also, 75 per cent of cases have met or exceeded expectations. 88 per cent of interviewees confirm this trend also in terms of social returns.

Siamo anche su WhatsApp. Segui il canale ufficiale LifeGate per restare aggiornata, aggiornato sulle ultime notizie e sulle nostre attività.

![]()

Quest'opera è distribuita con Licenza Creative Commons Attribuzione - Non commerciale - Non opere derivate 4.0 Internazionale.

At the dawn of a new era, women in Japan still face old challenges: they’re paid less than men and struggle to scale the professional ladder. How can the impasse be broken?

Inequality has increased anywhere in the world despite substantial geographical differences, with the richest 1% twice as wealthy as the poorest 50%. The results of the World Inequality Report 2018.

We talk to Samir de Chadarevian, an expert in sustainable development, philanthropy, impact investing and social innovation.

The global gender gap or index has widened, the 2017 World Economic Forum report shows. In view of the International Day for the Elimination of Violence against Women, we analyse how these phenomena are sadly related.

We can learn a lot from philanthropists and families investing their money for the future of all of us. We talk about this with Gamil de Chadarevian, founder of GIST Initiatives.

How do wealthy families invest their capital? Fortunately, impact investing is an increasingly common choice. An anticipation of some of the most important findings.

All companies aim to profit, but some of them are doing something for the society. They’re called benefit corporations.

In the next few months LifeGate will host a series of in-depth analyses on philanthropy and impact investing. This section is supported by Investing for Global Impact, a global research published by The Financial Times in partnership with GIST (Global Impact Solutions Today) and with the support of Barclays. Why philanthropy and impact investing, together In

The Bakken or Dakota Access Pipeline (DAPL), an underground oil pipeline project in the United States, is owned by a network of oil and pipeline companies, joint ventures and holding companies. After Trump revived it in January without the consent of the Sioux indigenous tribe affected by it and flouting environmental laws, many investors both from the US